- Crypto Market Capitalization Falls To $2.77 Trillion

- 10,000 Cryptocurrencies Have Lost Half Their Value In One Day

- Bitcoin Price Drops Below $60K, What Lies Ahead?

During the last 24 hours, crypto markets have significantly dropped in value. The entire market capitalization of all 10,000 crypto assets in existence has fallen below the $3 trillion mark at $2.77 trillion on Tuesday morning (EST).

As bitcoin’s price fell from $66K on Monday to the low of $58,563, it recovered some losses after the steep fall, rising back above the $60K range and showing signs of consolidation.

Why Is The Bitcoin Market Cap Dropping?

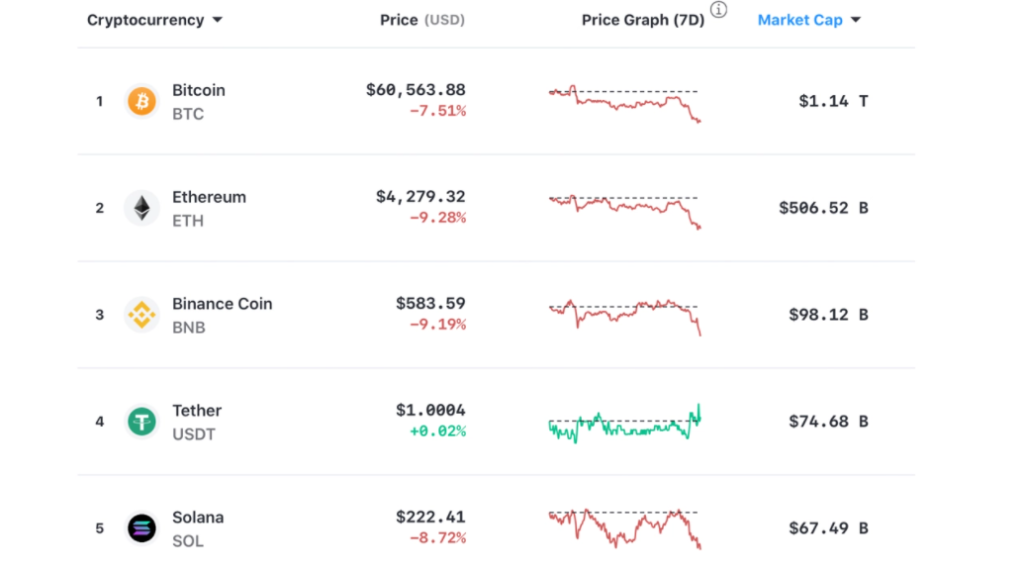

Digital currencies are down in value on Tuesday as the market capitalization of the entire crypto-economy shed billions over the past 24 hours. Bitcoin (BTC) is down 7.5% during the last 24 hours and 10.2% for the week.

Bitcoin currently trades for $60,563 per unit and has a market capitalization of $1.14 trillion. BTC had a 24-hour trade volume of 48 billion on Tuesday, with 52.43% of those trades involving tether (USDT).

Ethereum (ETH) has lost 9.2% overnight, and weekly statistics show ether has lost 11.6% as well following Bitcoin’s drop to just above $60K from $66K.

Despite the loss in most markets, coins like ecomi (OMI), nexo (NEXO), huobi token (HT), wonderland (TIME), and helium (HNT) have seen very little loss.

However, crypto assets like spell token (SPELL), kucoin token (KCS), near (NEAR), kadena (KDA), arweave (AR), dash (DASH), and zcash (ZEC) have lost between 15% to as high as 22.4% during the last day.

A Crypto Hedge Fund Manager Explains Why The Cryptocurrency Market Is Slowing Down

Ahead of the selloff in bitcoin, ethereum, and several other crypto markets, Ark36 hedge fund executive Mikkel Morch said the drop is normal.

“Bitcoin has yet again proven that it can defy expectations,” Morch added. “After hitting an all-time high near the 69,200 level last week, the overall expectation was that the trend would continue immediately.”

An unexpected drop in price might come across as disappointing or even concerning in light of last week’s market enthusiasm.” Mr. Morch continued:

It is important to remember, however, that a 8% drop is considered normal for the crypto markets.

In the short term, the overall bullish market structure remains intact. A sudden price drop results in a leverage shakeout, which takes place in a healthy market, which is better positioned to continue its upward trend.

What Is The Future of Cryptocurrency Markets?

Fundamental analysis of the Bitcoin market from Huobi Global indicates there are numerous factors indicating a bearish market sentiment at the moment.

Huobi Global told Bitcoin.com News on Tuesday morning that all EMAs indicated a steep decline to the downside, Bollinger bands opened wide, and the current indicators indicated a high bearish sentiment in the market.

On a daily basis, BTC is in a long negative line, the short-term uptrend has broken, daily volume has increased, therefore, the short-term trend may move lower. Pay attention to the support below, Huobi said.

Huobi said in a similar market outlook report that ethereum (ETH) market signals are also indicating a “high bearish sentiment in the market.

Based on a daily perspective, Huobi Global’s bitcoin and ethereum market outlook concluded that the upside channel of ETH may have become broken, and that this retracement fell below the short-term support level.