Technology is disruptive, and Bitcoin has been the most disruptive of them all. For the first time ever, Bitcoin dominance is at an all-time high. The crypto revolution is here, and the future is Bitcoin.

A price surge boosted Bitcoin’s dominance to $51,500, and Gary Gensler echoed Jerome Powell’s reassurance that US doesn’t plan to ban crypto.

NASDAQ and Dow Jones closed up 1.25 percent and 0.92%, respectively.

By partnering with NYDIG, US Bank will offer crypto custody services. Initially, it will only support bitcoin with the intention of adding more coins in the future.

DeFi/NFTs/Gaming

- Earlier this year, Sky Mavis, the developer of Axie infinity, raised $152 million from Andreessen Horowitz in a series B round. After its remarkable run during the past week, $AXS was last trading at $130, down 6%.

- ThorSwap, a decentralized exchange powered by ThorChain, raised $3.75 million in a private token sale. USDRUNE last traded around $8.90.

- Using Lido Finance ($LDO), a liquid staking solution, Nexus Mutual ($NXM), an insurance protocol built on ethereum, allocated nearly $50 million to earn ETH2.0 staking rewards.

Traditional Financial Markets

- To combat coal shortages, China turns to Australia’s abandoned mines.

- ISM’s September services PMI came in higher than expected at 61.9, up from 61.7 in August. Yields on the 10-year treasury rose to 1.534% on the news.

- The US gas price reached its highest close in 12 years due to supply concerns.

Gary Gensler: Futures-Priced Bitcoin ETFs Are Preferable to Spot-Priced Ones

According to Noelle Acheson, Head of Market Insights at Genesis, one of the most recent developments is that Gary Gensler reiterated last week that he preferred bitcoin futures ETFs over spot-priced ones at a conference last week.

The CME also announced on Friday that it was doubling the limits on initial Bitcoin futures positions. Notably, this new rule will go into effect on October 18th, the same day the SEC is expected to rule on the ProShares Bitcoin Futures Strategy ETF.

The CME may be planning a surge in futures volumes, or it may be a coincidence.

Increasing BTC’s Dominance

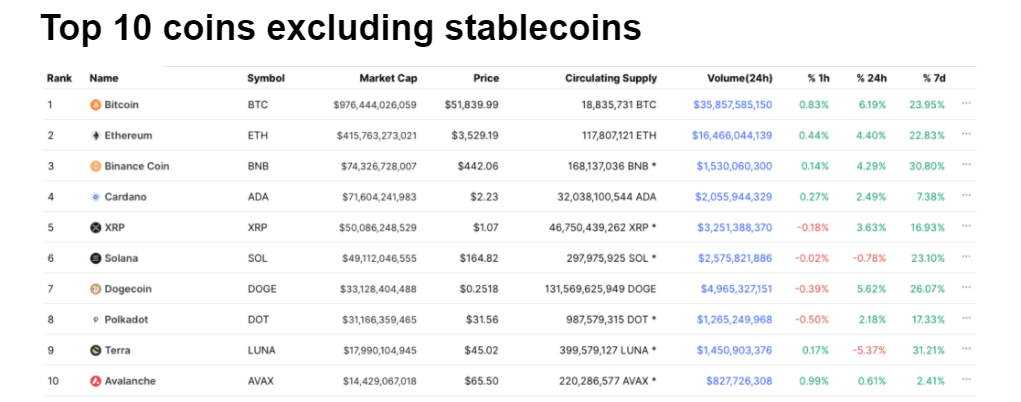

It has historically set the stage for future alt coin rallies by increasing BTC’s dominance, or its share of total crypto market capitalization, by 5.16% over the last month.

The perpetual funding rates of Bitcoin vary across exchanges, which causes traders to differ in their opinions about whether to take a short or long position.

- The traditional financial markets have been volatile in the past week, but bitcoin has shown significant strength, investing more than 23% in the past week. The approval of an ETF backed by futures could lead to a rally by the end of the year.

- The poor performance of layer-1 indicates that money is moving to the blue chips: bitcoin and ether.

US Crypto Regulations

- The Minnesota congressman, Tom Emmer, posted a response on Twitter calling out Gary Gensler’s attempt to classify some digital assets as securities. He feels that would do more harm than good to retail investors.

- The Clarity for Digital Tokens Act was introduced today by Rep. Patrick McHenry (R-NC). This bill aims to keep innovation in the US and provide clarity to those involved with digital assets.

- Gary Gensler, chairman of the Securities and Exchange Commission, echoed Jerome Powell’s comments that the U.S. has no plans to ban crypto.

Initially published here.