The US SEC has proven to be a difficult nut to crack for the crypto community when it comes to approving Bitcoin ETFs. There have been several proposals rejected by the SEC, with new ones popping up on a monthly basis. This time around, however, it’s not another ETF application we’re talking about – but rather a specific entity that is trying to get its hands on the green light so it can launch one. Grayscale’s Bitcoin Trust is looking to become the first ever publicly traded cryptocurrency-focused exchange-traded product (ETP). In this article, we will take an in-depth look at why Grayscale thinks its trust should be approved as an ECT and what implications such a decision would have on this market segment from here onwards.

The SEC will announce whether it has approved Grayscale’s application to transform its flagship Bitcoin Trust into a spot ETF on July 6.

Grayscale, which manages $43 billion in cryptocurrency, has reportedly launched a marketing campaign asking people to “support a Bitcoin ETF” to the United States Securities and Exchange Commission (SEC).

Axios reports that a Grayscale advertisement appeared in Washington D.C.’s Union Station, stating “we care about crypto investors,” and containing a QR code that directs viewers to a page where they can submit their comments to the SEC.

The QR code directs users to the SEC, as Decrypt has confirmed with Grayscale.

A spokesperson for Grayscale told Decrypt the ad campaign launched in April and will run through the end of July. As well as the Union Station location, Rosenthal said that the campaign will also appear in various newspapers, such as the New York Times, Wall Street Journal, and Washington Post.

Advertisements are also displayed on Amtrak trains and NYC bus links, and they will soon appear on MTA live boards and in airport lounges as well.

With its campaign, Grayscale hopes to see the SEC approve a Bitcoin spot exchange-traded fund (ETF).

Spot ETF applications have largely been rejected by the federal securities regulator. Still, Grayscale is hoping its advertising and industry clout will return a different verdict from the SEC on JulyCurrently, the SEC is accepting comments on the application process. Anyone may submit comments to the SEC for consideration.tion.

The SEC has received more than 2,600 comments.

The purpose of Grayscale’s ETF

Until ETFs are available, products like Grayscale’s Bitcoin and Ethereum Trusts provide investors with access to crypto through traditional investment platforms, including public pricing, legal counsel, and auditors.

Greyscale’s products have still attracted investors despite a 2% management fee. Currently, it holds $18.7 billion in its flagship offering, the Bitcoin Trust (GBTC).

It would be cheaper to manage a crypto ETF than a crypto trust. Moreover, Grayscale would be able to reprice its Bitcoin Trust according to the underlying asset’s price.

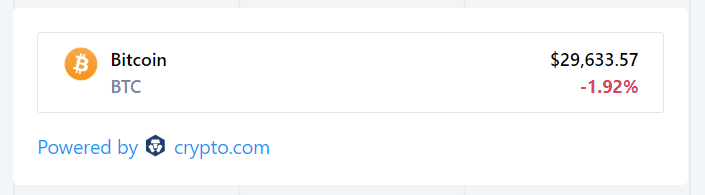

According to its net asset value (NAV), shares of GBTC hit a record low last month. Based on data from YCharts, it is currently trading at a discount of 30.72%, although it has historically traded at a premium of 37%.

Greyscale formally filed for an ETF conversion of its flagship Bitcoin Trust (GBTC) in October 2021.

Grayscale says an arbitration mechanism would be activated through simultaneous share creations and redemptions if the SEC approves the conversion of GBTC into a Bitcoin Spot ETF, likely realigning GBTC share prices to trade in line with NAV.

Rosenthal told Decrypt that Grayscale has “all options on the table” in the event that it is denied its Bitcoin ETF application by the SEC.

Via this site.