In spite of an ongoing market correction and a nationwide crypto ban, Chinese Bitcoin ( BTC ) investors plan to buy the dip.

Polls Predict Bitcoin at $10K

Chinese social media platform Weibo surveyed 2,200 users and found that 8% said they would buy Bitcoin when it reaches $18,000, according to Wu Blockchain. Approximately 26% of respondents prefer to wait for BTC to reach $15,000.

Most, however, believe the price will fall even further, with 40% predicting $10,000 as the price at which they will buy BTC.

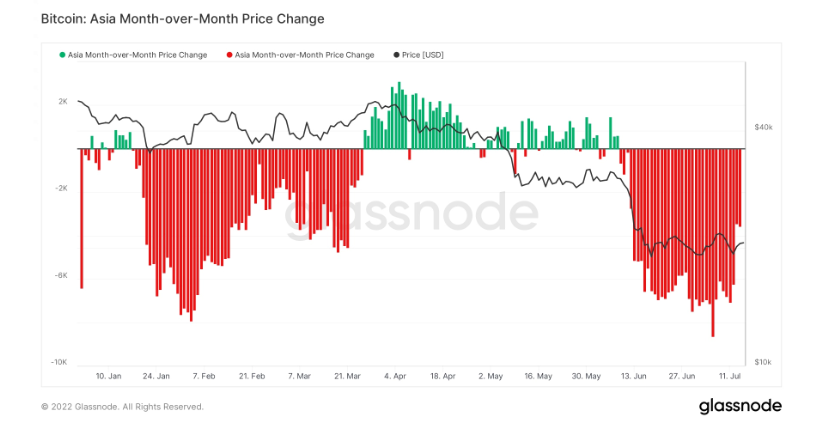

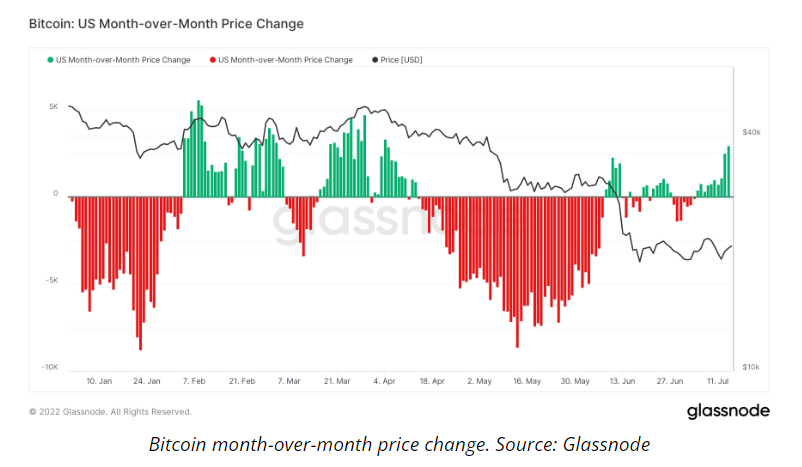

Chinese vs US Month-Over-Month Price Change

An earlier Bloomberg MLIV Pulse survey conducted in July showed a similar result, with 60% of the net 950 Wall Street respondents calling for $10,000 Bitcoin.

Crypto speculators in the United States and China exhibit striking similarities in their bearish sentiments. Since June 2022, on-chain activity indicates that investors in the U.S. have been more bullish on Bitcoin than their Asian counterparts.

It has been positive only during U.S. sessions that Bitcoin’s month-to-month price change has tracked the change in the regional BTC price over the past 30 days. It has been positive only during U.S. sessions that Bitcoin’s month-to-month price change has tracked the change in the regional BTC price over the past 30 days.

Investors Expect BTC Price at $13K and Below

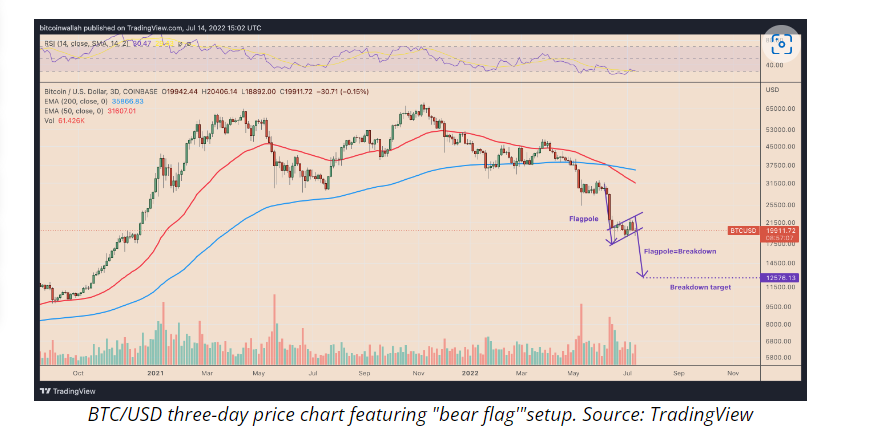

Meanwhile, technical indicators are weakening, particularly on three-day timeframes, supporting further downside.

According to the above illustration, Bitcoin is forming a potential “bear flag” pattern that could lead to a drop below $13,000 by September.

In Cointelegraph’s report, persistent macroeconomic headwinds continue to fuel bearish arguments against an imminent price bottom for bitcoin/usd.

Via this site.