Bitcoin mining is a competitive market with only a few powerhouses dominating the process. The liquidity and the speculative value of Bitcoin has been pushed up to new heights over the past year, but it seems like the bubble might not last forever. The market volatility in bitcoin has caused some to worry about a possible bitcoin mining shakeout. Miners are selling coins at a record rate as these companies race to sustain margins as they are under pressure from competition, production costs and other factors.

Some Bitcoin miners are trading in their diamond hands to pay for their picks and shovels because of cash and capital concerns.

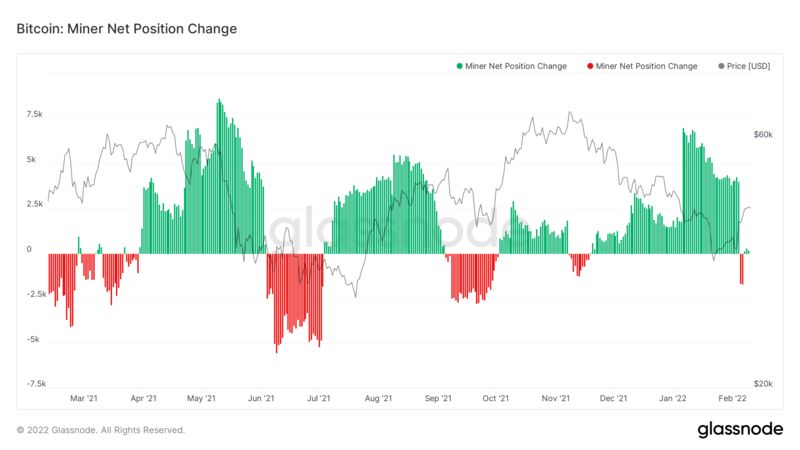

According to crypto analytics platform Glassnode, a metric tracking Bitcoin miners’ holdings turned negative on Feb. 5 for the first time since mid-November.

This change in the metric, which measures the change in miner balances over a 30-day period, shows that miners are selling their coins, which may indicate a shakeout of less-efficient operators is imminent.

Miners were adding to their stockpiles for months, even as prices fell to $35 per coin. Despite this, Bitcoin is still hovering around 35% below the all-time high set in November, which forces miners with expensive operations to keep an eye on their cash balances as well as invest in better equipment.

Shares of the larger miners are rebounding after the recent sell-off. Marathon Digital Holdings Inc., Riot Blockchain Inc., Stronghold Digital Mining Inc., and Hut 8 Mining Corp. are up more than 40% from their January lows. However, smaller miners could be hurt by the recent selloff.

Hut 8 and Marathon Digital said they hodled during the recent crunch. “We started hodling in October 2020, and we haven’t sold a single satoshi since then,” Marathon Digital spokeswoman Charlie Schumacher said. The satoshi, derived from the name of Bitcoin creator Satoshi Nakamoto, is a percentage of a coin. Similarly, Sue Ennis, Hut 8 Mining’s investor relations chief, said: “We believe in Bitcoin.” Miners sometimes sell Bitcoin or use it to pay expenses. We hold on to ours.”

Riot and Stronghold did not respond to emailed inquiries. Bitcoin miners have committed to growing by buying more mining rigs and increasing the rate at which they can mint Bitcoins. Due to the way both equity and crypto markets are performing, Lucas Pipes, a B. Riley analyst, said that there’s “little margin for error” in execution this year compared to 2021.

“The machines got much more expensive. If you promised to raise exahash to a certain level, you’d have to spend 20% to 30% more to do it,” he said, referring to the Bitcoin processing rate.

Via this site.