Bitcoin has been on a wild ride since its release in 2009. It’s currently hovering around $48,040.79 USD as of this writing. Regardless of what people say about Bitcoin being dead or dying, many see the cryptocurrency as their opportunity to amass wealth without being subject to the whims of banks and governments.

With Bitcoin’s price action, there is a chance for Bitcoin to rally more than 30%. The bull market will resume today if there is a bullish reversal up ahead. The short squeeze ahead will be large.

In yesterday’s candlestick, there were many new short positions that were opened, and those new short sellers are likely feeling the pressure as bitcoin prices rise.

Bitcoin price to explode close to its all-time highs

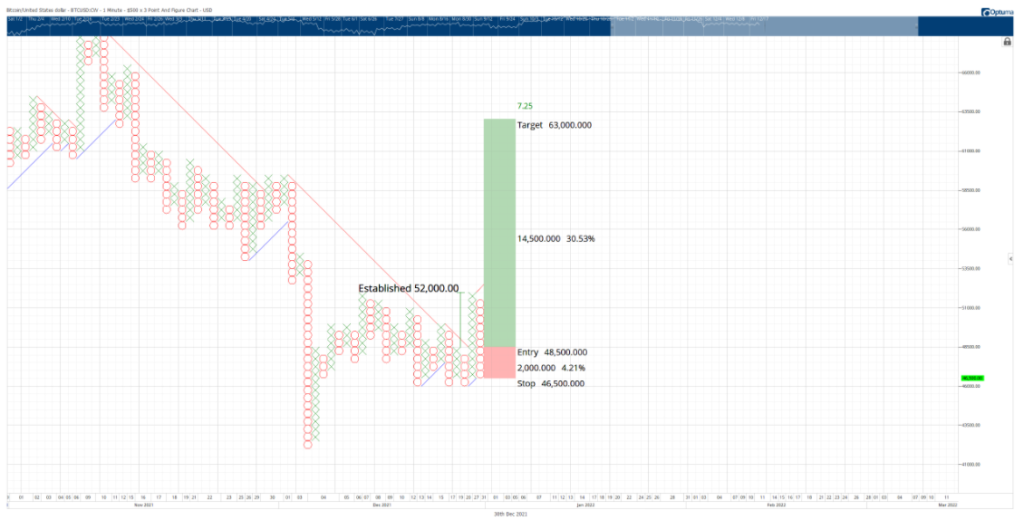

This entry is based on a Point and Figure pattern known as a Pole Pattern that is not present on the candlestick chart. The entry is based on an earlier entry based on a slight deviation from the Pole Pattern.

According to the long setup for Bitcoin price, the buy stop is currently located on the 3-box reversal, currently at $48,500. The stop loss is located on the 4-box reversal, currently at $46,500, and the profit target is $63,000.

Basically, this Point and Figure pattern suggests lower prices as well as a lower buy stop. Thus, the stop loss remains a 4-box stop, and the profit target, calculated using the Vertical Profit Target Method, remains $63,000.

With an implied profit target of 30% above the entry, this trade represents a 7.25:1 reward for the risk setup. Two to three boxes of trailing stops would help protect any profit generated after the entry is triggered.

Traders should expect some resistance at $55,000 range before further upside momentum can be expected for Bitcoin price. Since this long setup is based on the pole pattern setup, there is no invalidation point. As Bitcoin price drops, so does the entry.

Via this site.